Preface#

LUSD, I believe everyone is familiar with it, is a decentralized stablecoin from Liquity Protocol. Unlike MakerDAO's DAI, LUSD only has ETH as collateral, and the Collateral Ratio can be as low as 110%. Since Tornado Cash was sanctioned by OFAC and Circle blacklisted all Tornado-related addresses to freeze USDC, the cryptocurrency community has begun to rethink the harm of centralized stablecoins to DeFi and Ethereum's censorship resistance. Many people have started choosing truly decentralized stablecoins like LUSD and RAI, which has led to a continuous premium on LUSD.

Opportunity#

Not long ago, Fei Protocol announced its dissolution and will sell most of its PCV assets for DAI. From here, I smell a profitable opportunity. Could it be the revaluation of $TRIBE, arbitrage opportunities with $FEI, or shorting opportunities in the PCV assets?

https://tribe.fei.money/t/tip-121-proposal-for-the-future-of-the-tribe-dao/4475

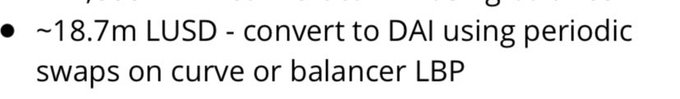

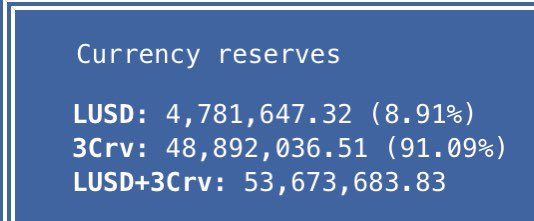

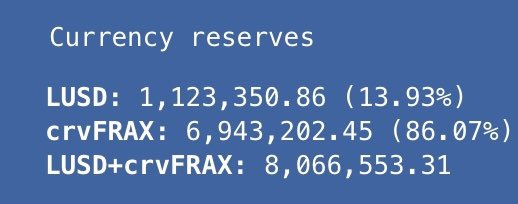

By carefully reading, it can be found that Fei will sell 18.7m LUSD through the LBP Auction method, which is 10% of the circulating supply of LUSD! This is bound to reduce the premium on LUSD. Through testing, selling LUSD on 1inch can cause a price impact of about 2.6%, which is a deterministic shorting opportunity! Compared to the more uncertain shorting of ETH, I chose the risk-free shorting of LUSD.

.@feiprotocol dumping their 18.7m LUSD (10% of total supply) for DAI is actually…… good for @LiquityProtocol, as it effectively rebalances pool ratios -> repegging LUSD to $1 -> more confidence in LUSD to maintain peg for the time being -> more troves opened

.@feiprotocol dumping their 18.7m LUSD (10% of total supply) for DAI is actually…… good for @LiquityProtocol, as it effectively rebalances pool ratios -> repegging LUSD to $1 -> more confidence in LUSD to maintain peg for the time being -> more troves opened pic.twitter.com/ExGz1s1nIO

— Barry Fried 🦇🔊 (@BarryFried1) August 19, 2022

Strategy#

With a 3% premium on LUSD and 10% of LUSD supply about to be sold, it is clear that there are arbitrage opportunities. It's time to formulate a strategy.

The strategy is actually very simple, just two points:

-

Shorting

Shorting means opening a trove on Liquity to borrow LUSD and sell it in the market, then buy it back at a lower price after Fei sells LUSD. Taking into account the 0.5% minting fee, the maximum profit can reach ~2%, with a maximum time cost of 3 days. The advantage of this approach is passive income without the need for active arbitrage trading.

-

LBP Auction Arbitrage

During the LBP Auction, arbitrage can be done actively on Balancer. During the LBP, the price of LUSD on Balancer will continuously decrease, creating a difference with the Curve pool price, which can be profitable. The advantage of this approach is the ability to make big profits in a short period of time, but it requires competing with MEV bots for gas and has a high probability of failed transactions, so it is only feasible in the early stages of the LBP.

Execution and Observations of Arbitrage Participants#

On the morning of the 28th, I saw that Fei's vote on tally.xyz had passed. The code on tally.xyz is executed automatically, and after inquiring on Fei's Discord, I learned that there is a 24-hour time lock, so the LUSD LBP Auction will start automatically 24 hours after the proposal is passed.

Next is the execution. After dozens of manual buy and sell operations, the profit reached over $3,000. As shown in the figure below, the profit from this trade alone can reach $300. Of course, there were also multiple failures and being sandwiched by MEV during manual trading. In the end, by continuously adjusting the slippage and gas with the Rabby Wallet's transaction simulation feature, I was able to get a better rate than other manual traders. In the end, by shorting and manual arbitrage, the profit reached over $4,000.

Observations of Participants:#

Shorters

In the LBP Auction, I noticed that Aave passed a proposal to add LUSD as a borrowable asset in Aave V2, which provides a new tool for shorting LUSD. Compared to borrowing on Liquity, borrowing on Aave is more suitable for shorting in the short term (saving the 0.5% minting fee).

https://app.aave.com/governance/proposal/95/

For example, this address 0x95ecfcc073f1d768be35839dd27724a0aed78e60 borrowed 100,000 LUSD from Aave and immediately sold it, exchanging 100,000 LUSD for 101,312 USDT.

Arbitrage Whales

While I was manually doing LBP arbitrage until I felt that the profit margin was compressed to the point of being unprofitable, there was an address tirelessly conducting arbitrage at a rate of 10,000 DAI per transaction day and night. The address of this whale is 0x38abab9766e0b27d2912718a884292b8E7eb2803.

This whale absorbed nearly two million LUSD from the LBP at its peak. Instead of directly market selling the LUSD, the whale cleverly used the 1inch limit order method to absorb the buying pressure for LUSD. The whale also made me discover that LUSD can be exchanged for sUSD at a 1:1 ratio using the Synthetix Wrapper.

Conclusion#

As the raccoon once said, many alphas are in the project's Governance Forum. If you only see the news of Fei's dissolution without reading the specific proposals, you will miss out on money-making opportunities. The next step is to formulate reasonable strategies and execute them effectively. Even during the execution, there are many new discoveries, such as new trading paths and new shorting tools. Therefore, always maintain curiosity and a desire to learn. These little pieces of knowledge may become the key to making money one day.

If you have more interest in the development of Liquity Protocol and LUSD, I recommend reading the following resources:

About LUSD peg:

https://www.liquity.org/blog/the-premium-of-resiliency

About Liquity's new product, LUSD Chicken Bond: